Disclosure based on TCFD recommendations

In 2025, the Link and Motivation Group began disclosing information based on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). We take stock of our countermeasures based on the four core elements proposed by the TCFD (governance, strategy, risk management, and metrics and targets) and work to communicate information with a high degree of transparency.

For “strategy” in particular, we conducted our first scenario analysis based on 1.5°C and 4°C scenarios to identify significant risks and opportunities for the Group’s business that climate change could cause going forward. We will reflect the results of this analysis in future management decisions and in increasing the sophistication of risk management.

We will continue working to step up our response to climate change as we make ongoing improvements to our initiatives in line with the TCFD recommendations.

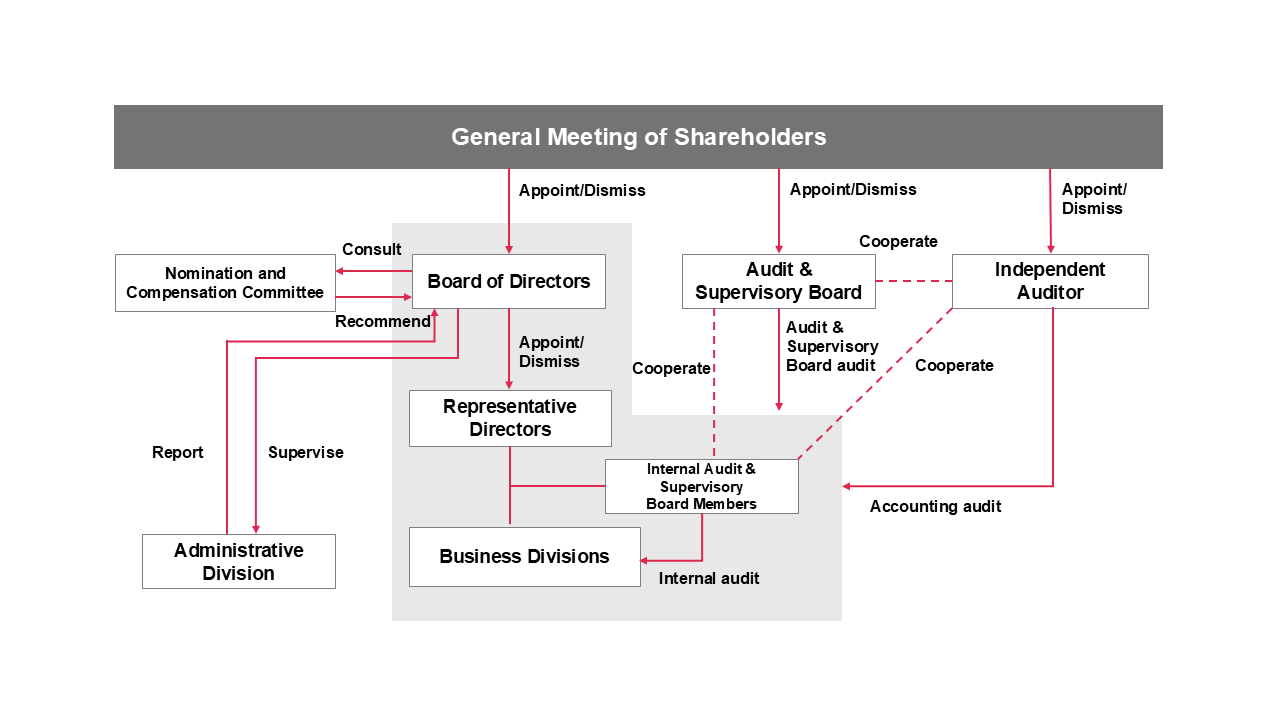

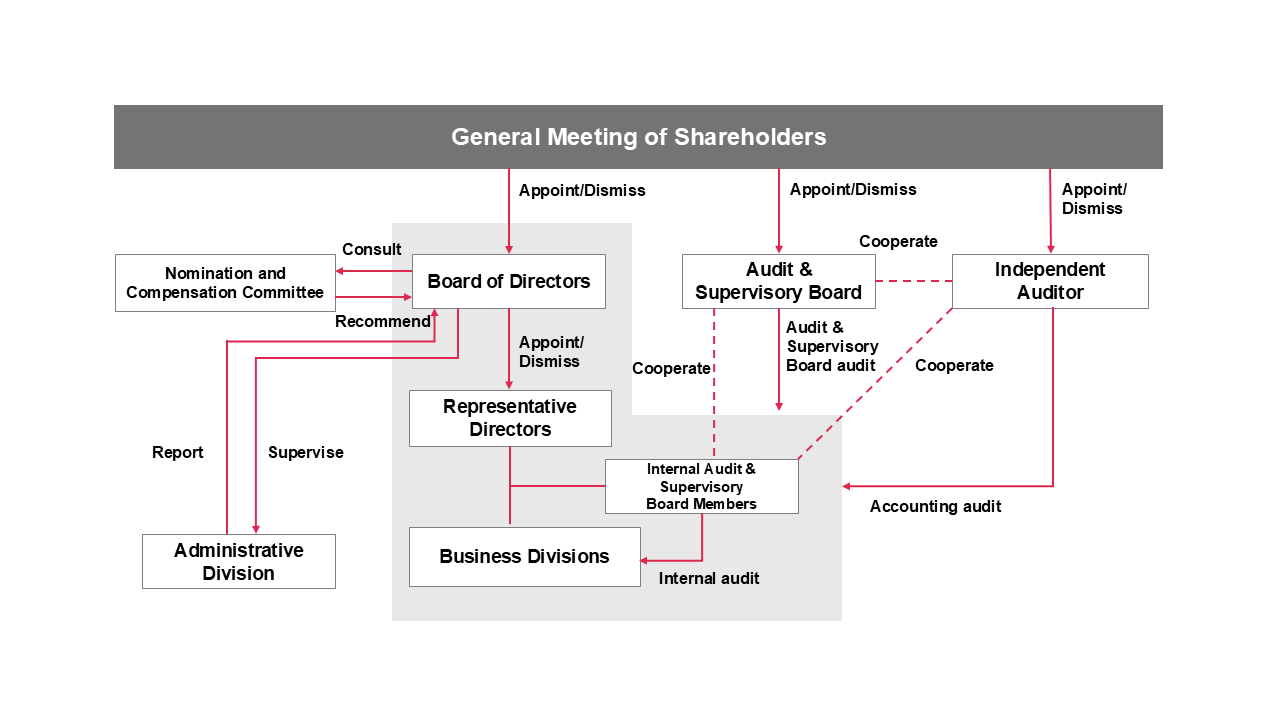

Governance

The Board of Directors is the top decision-making body for determining basic management policies, key issues and important matters stipulated by law, and generally meets once a month. It deliberates and decides on management strategies, including important policies related to sustainability, for sustainable improvement in corporate value.

We have also established a process whereby the Administrative Division reports to the Board of Directors once a year on sustainability-related matters, including climate-related risks and opportunities.

In addition, to facilitate speedy decision-making and flexible organizational responses in managing our business, we generally hold Management Committee meetings twice a month, attended by directors, full-time Audit & Supervisory Board members, corporate officers, business managers and others. For climate-related matters, the officer in charge takes the lead in monitoring risks, opportunities and actual CO2 emissions.

Strategy

Scenario Analysis Assumptions

We are conducting scenario analyses to assess the medium- to long-term risks and opportunities for our business associated with climate change. The analysis in 2025, covering all Link and Motivation Group companies in Japan, identified risks and opportunities from projected future impacts and estimated the financial impact in 2030 and 2050. The scenarios we assumed were a 4°C scenario in which existing policies remain unchanged, and a 1.5°C scenario in which decarbonization policies are proactively promoted in order to limit the rise in global average temperature by the end of the twenty-first century to 1.5°C above pre-industrial levels.

The assumptions for the scenario analysis we conducted this time are summarized below.

| Scope | All Group companies in Japan |

|---|---|

| Time frame definition | Short-term: 2028; Medium-term: 2030; Long-term: 2050 |

| Temperature scenarios | 1.5°C scenario and 4°C scenario |

| 1.5°C scenario | 4°C scenario | |

|---|---|---|

| Assumptions | A scenario assuming the introduction of policies and regulations for decarbonization and progress in technological development to limit the rise in global average temperature by the end of the twenty-first century to 1.5°C above pre-industrial levels. | A scenario for a 4°C rise in global average temperature above pre-industrial levels by the end of the twenty-first century, with increased physical damage from typhoons and other factors. It assumes that current policies, regulations, and technological developments will remain unchanged. |

| Scenarios referenced* | ・IEA Net Zero Emissions (NZE) ・IPCC SSP 1-1.9 |

・IEA Stated Policies Scenario (STEPS) ・IPCC SSP 5-8.5 Scenario |

- *Overview of scenarios referenced

- IEA NZE: A 1.5°C scenario published by the International Energy Agency (IEA) in which net zero CO2 emissions are achieved by 2050

- IEA STEPS: A 4°C scenario published by the International Energy Agency (IEA) in which existing policies remain unchanged without any additional measures

- IPCC: Intergovernmental Panel on Climate Change

- IPCC SSP 1-1.9: A 1.5°C scenario from the IPCC in which CO2 emissions become net zero by around 2050, and the rise in temperature by the end of the twenty-first century is limited to 1.5°C

- IPCC SSP 5-8.5: A 4°C scenario from the IPCC that assumes that both CO2 emissions and average temperatures continue to rise, with a temperature rise of 4°C or more by the end of the twenty-first century.

Process for Conducting the Scenario Analysis

For the scenario analysis, we began by listing the climate-related transition and physical risks and opportunities expected throughout the Group’s entire value chain, from which we selected items we believe to have a particularly large potential impact on the Group. Next, for each risk or opportunity identified, we referred to scenarios from outside the Group to consider the external environment and the situation of the Group assumed under the 1.5°C and 4°C scenarios for each target year, and prepared the calculation methodology that serves as the basis for calculating financial impact and the internal and external data required for the calculation. (After calculating the actual financial impact using the collected data, we evaluated the materiality for the Group.)

Financial Impact Analysis Results

The risks, opportunities and financial impact identified through scenario analysis, as well as our policy for addressing them, are as follows.

The risk of financial impact from the risks we identified is expected to be relatively low.

However, due to growing investor awareness of sustainability, we expect revenues from our IR Support business to have a significant financial impact in 2030 and 2050 under the 1.5°C scenario.

We also expect our Personnel Placement business to see a moderate financial impact in the decarbonization market in 2050 under the 1.5°C scenario, and recognize this as an opportunity to increase the Group’s corporate value.

We will continue to conduct scenario analyses to further improve their accuracy, and will incorporate forecasts derived from this analysis into our process for considering management strategies in order to increase our resilience in dealing with the uncertain world that lies ahead.

| Type | Category | Item | Impact on the Group | Degree of impact* | Response | |||

|---|---|---|---|---|---|---|---|---|

| 4℃ scenario |

1.5℃ scenario |

|||||||

| 2030 | 2050 | 2030 | 2050 | |||||

| Transition risks | Policies, laws and regulations | Carbon tax | The introduction of a carbon tax on purchased goods and services (Scope 3, Category 1) will increase operational costs. | Low | Low | Low | Low | Reduce greenhouse gas (GHG) emissions by reducing use of paper resources and thoroughly managing office air conditioning, among other measures. |

| Market | Changes in customer behavior | The increased risks of heatstroke due to rising temperatures, and of flooding due to heavy rainfall leads to a decline in demand for face-to-face career schools and cram schools, resulting in a decrease in revenues in the Individual Development Division. | Low | Low | Low | Low | Provide a greater proportion of classes online along with the expansion of the lineup of online courses. | |

| Physical risks | Acute | Abnormal weather | If data centers are flooded due to typhoons or heavy rain and servers are shut down, Cloud business revenues will decrease due to lost opportunities. | Low | Low | Low | Low | Expand both Cloud and Consulting operations. |

| Flood damage will shut down school operations in classrooms, resulting in a decrease in revenues. | Low | Low | Low | Low | Provide a greater proportion of classes online along with the expansion of the lineup of online courses. | |||

| Opportunities | Products / Services | Changes in customer behavior | Higher investor awareness of sustainability will increase needs in investor relations, raising revenues in the IR Support business. In addition, trends in seeking to improve disclosure content will also lead to increased revenues in the Consulting & Cloud business. | Low | Low | High | High | ・Increase headcount at the Organizational Development Division. ・Expand services to meet diverse needs for disclosure. |

| Market | Decarbonization market | The transition to a decarbonized society and economy will increase demand for personnel placement due to the shift of human resources away from high-emissions industries such as fossil fuels, leading to increased revenues in the Personnel Placement business. In addition, the need for improved engagement associated with this shift in human resources will also lead to increased revenues in the Consulting & Cloud business. | Low | Low | Low | Medium | ・Expand services to meet diverse career needs. ・Step up communication about the importance of engagement. |

|

- *Degree of impact High: ¥4 billion or more; Medium: ¥1 billion or more but less than ¥4 billion; Low: Less than ¥1 billion

Risk Management

To deliberate on the various risks related to Group management, we have established a system under which we regularly monitor, assess and analyze the status of major risks, provide necessary instructions and oversight to each Group company, and periodically report the details to the Board of Directors.

For climate-related risks, we have established a process to distinguish and identify transition risks (such as regulatory and market changes) and physical risks (such as an increase in natural disasters) after conducting a materiality assessment that takes into account the scope of the risk’s impact and the scale of the related business. The assessment also considers current and future policy trends, such as the introduction of a carbon tax. We assess the materiality of these risks based on their degree of impact and likelihood, set priorities, and study and implement policies for countermeasures in collaboration with relevant divisions. The linked process of identifying, assessing, and managing climate-related risks is comprehensively operated as part of the Group’s risk management system. Like other strategic and financial risks, such risks are managed and reported within the Group’s risk management framework.

Metrics and Targets

The Link and Motivation Group has set GHG emissions (Scope 1, 2 and 3) as an indicator for managing its initiatives related to climate change. We do not conduct any activities for which Scope 1 is applicable, and calculations for Scope 2 use location-based and market-based standards. We began calculating Scope 3 emissions in 2024 . We will continue to make calculations each year and improve their accuracy. Although we have not set targets as of December 31, 2024, we will continue working to reduce GHG emissions in order to achieve carbon neutrality by 2050.

Scope 1 and 2 Emissions

| (t-CO2) | 2023 | 2024 |

|---|---|---|

| Scope1 | 0 | 0 |

| Scope 2 (location-based standard) |

1,284 | 1,391 |

| Scope2 (market-based standard) |

1,311 | 1,409 |

- Notes:

- 1. Calculations based on the GHG Protocol covering all Link and Motivation Group companies in Japan (excluding OpenWork Inc.).

- 2. Emissions intensities used in the calculations are taken from the List of Emission Factors by Electric Utility Operator from the Ministry of the Environment of Japan.

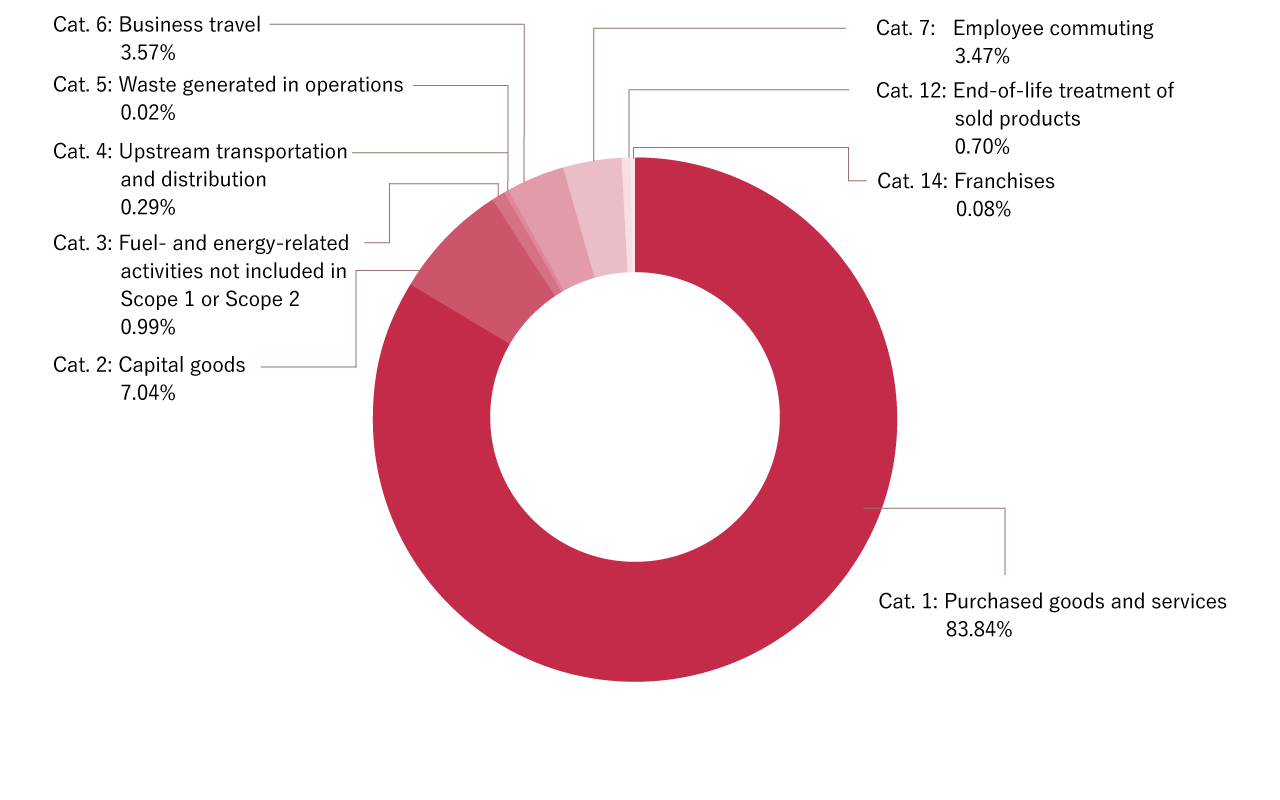

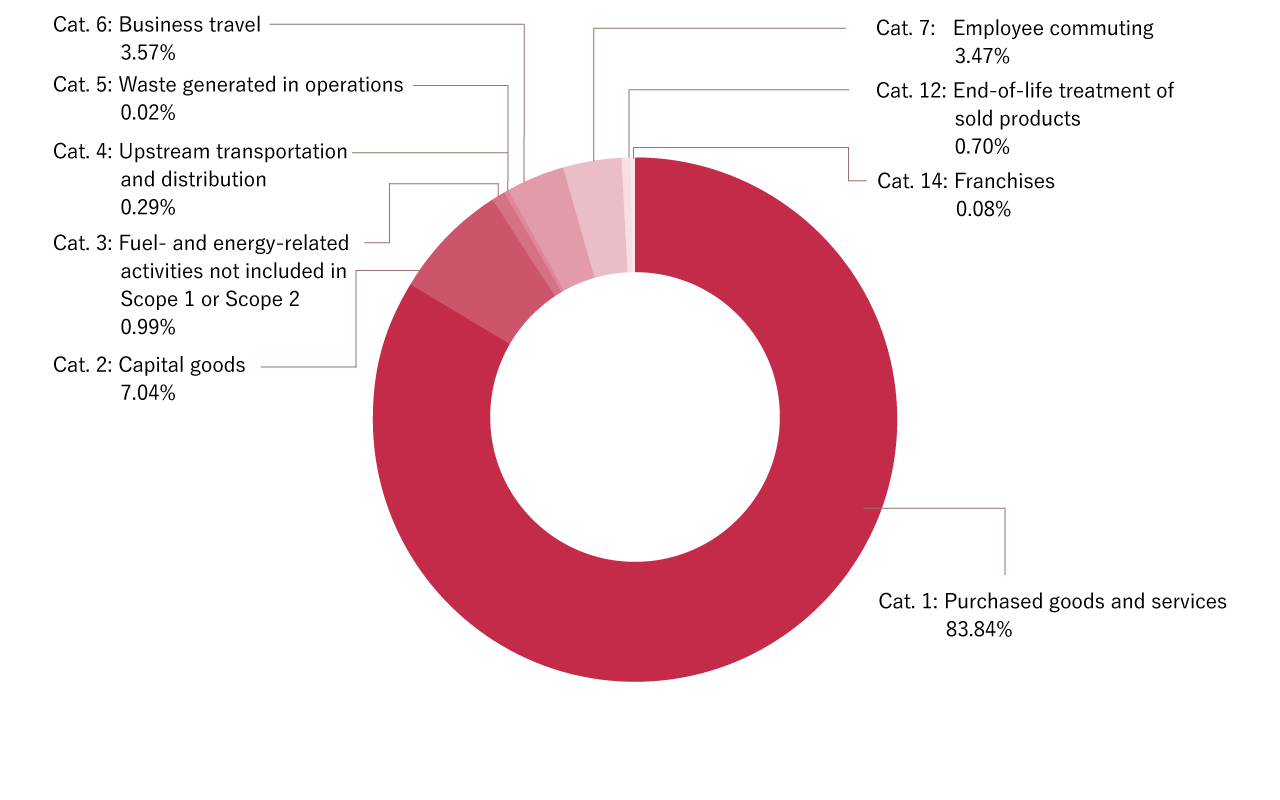

Scope 3 Emissions by Category (t-CO2)

| Category | Emissions (t-CO2) |

|---|---|

| Category 1: Purchased goods and services | 19,411.46 |

| Category 2: Capital goods | 1630.95 |

| Category 3: Fuel- and energy-related activities not included in Scope 1 or Scope 2 | 228.63 |

| Category 4: Upstream transportation and distribution | 67.87 |

| Category 5: Waste generated in operations | 3.61 |

| Category 6: Business travel | 826.96 |

| Category 7: Employee commuting | 802.44 |

| Category 8: Upstream leased assets | ― |

| Category 9: Downstream transportation and distribution | ― |

| Category 10: Processing of sold products | ― |

| Category 11: Use of sold products | ― |

| Category 12: End-of-life treatment of sold products | 161.96 |

| Category 13: Downstream leased assets | ― |

| Category 14: Franchises | 18.07 |

| Category 15: Investments | ― |

| Scope 3 Total | 23,151.95 |

- Notes:

- 1.Calculations based on the GHG Protocol and covering all Link and Motivation Group companies in Japan.

- 2.Emissions intensities used for calculations reference the Emissions Intensity Database Version 3.5, published by the Ministry of the Environment of Japan.

- 3.Dashes indicate categories that are not relevant due to the nature of the Link and Motivation Group’s businesses.